Biggest Defence Companies In The UK: A Guide

21.03.25

21.03.25

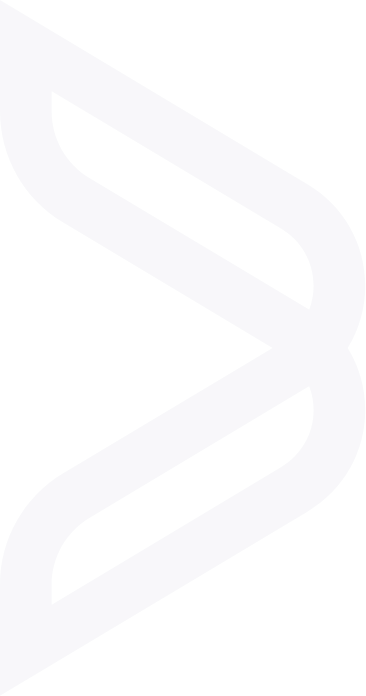

Click for a snapshot of the biggest UK defence companies.

The defence industry is experiencing a boom, with global unrest – including the war in Ukraine – fuelling significant investments in military and security spending. For many companies, now is an opportune time to either enter this market, or increase their presence as funding increases.

The UK Government in particular has recently announced that it will increase defence spending to 2.5%, and that could increase again further into the 2020s. Much of this spending will go on technology and equipment, creating jobs across the supply chain for those companies that create defence-specific or dual-use products and services.

But what are the biggest companies in the UK defence sector? Here we provide a helpful list breaking down the top defence companies in the UK, many of which are strategic suppliers to the UK Ministry of Defence (MoD) and are key buyers in the market.

BAE Systems is the UK’s biggest defence company, generating £26bn in revenue in 2024. While headquartered in the UK, the company has a significant presence across the globe, including the United States where it supplies a range of systems to the US Department of Defense (DoD).

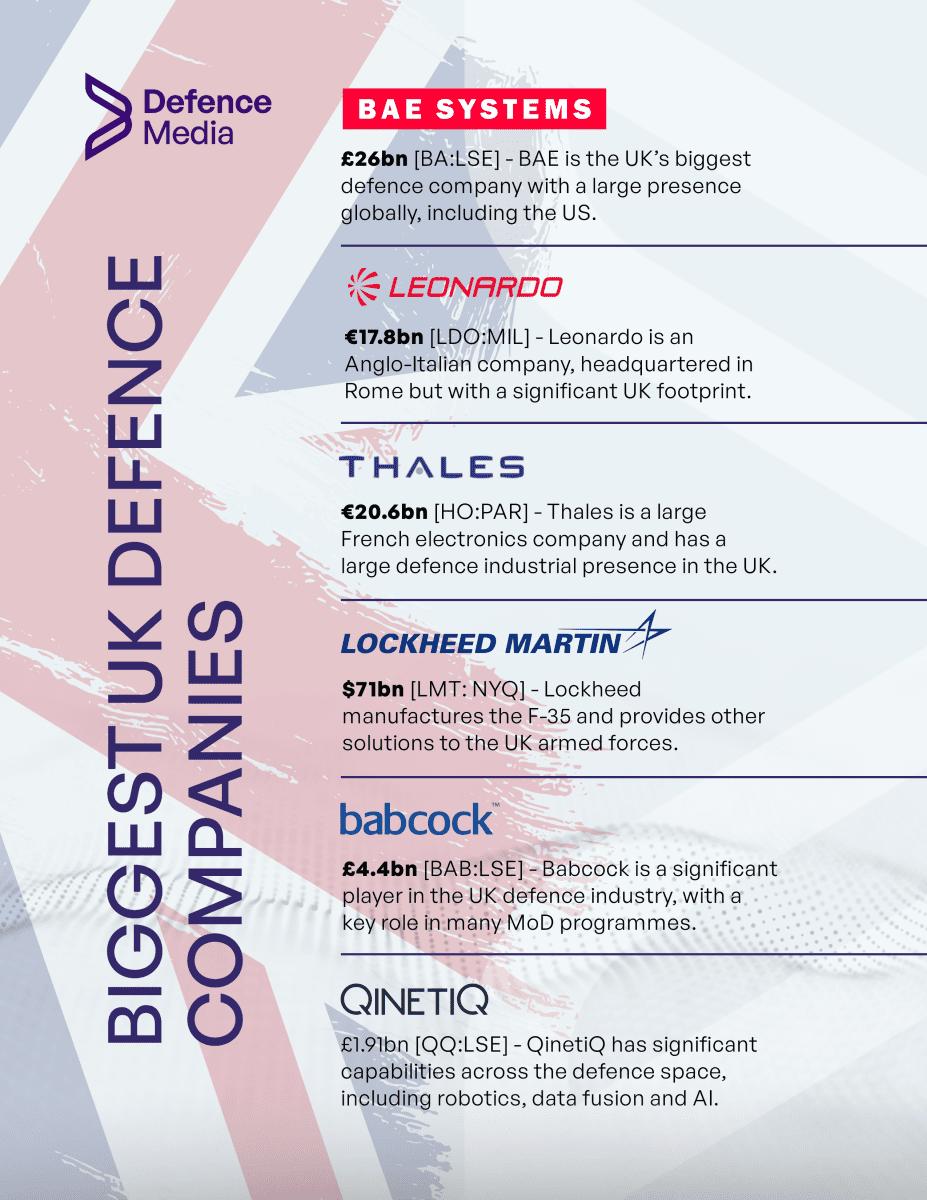

BAE Systems has sites across the UK, including submarine building in Barrow-in-Furness and shipbuilding in Scotland. The company also designs and manufactures military aircraft, and BAE Systems is one of the lead members of the Global Combat Air Programme (GCAP), which aims to introduce a next-generation fighter for the UK and other nations.

BAE Systems is the lead partner for the GCAP programme (Photo: Defence Media).

Leonardo is an Anglo-Italian company, headquartered in Rome but with a significant presence in the UK under the company name Leonardo UK. The company has a long UK heritage, particularly in the design and manufacture of advanced defence electronics and helicopters, with former companies such as Marconi and Westland being part of its DNA.

Today, Leonardo UK supplies many of the major sub-systems for the RAF’s Eurofighter Typhoon, including its radar and protection systems. The company is also a key member of GCAP, and supplies a range of systems to the Royal Navy and British Army. In Yeovil, the company manufactures military helicopters for customers across the globe, including the AW159 Wildcat.

The Royal Navy’s Wildcat is manufactured by Leonardo in Yeovil (Photo: Defence Media)

Lockheed Martin is a US company with a significant international footprint, including in the UK. The company is the manufacturer of the F-35, which the UK’s Royal Air Force and Royal Navy operate. In addition, Lockheed Martin provides training and other solutions to the UK armed forces, including the British Army’s Combined Arms Tactical Trainer (CATT) programme, as well as space technologies.

Additionally, Lockheed is in a joint venture with Babcock called Ascent Flight Training, which provides rotary and fixed-wing flight training to the British Armed Forces.

Lockheed and Babcock provide UK flight training as part of Ascent Flight Training (Photo: Defence Media)

Thales is a large French electronics company with a significant portion of its solutions suited for the defence market. Through various acquisitions it has a large industrial presence in the UK and is a critical strategic partner for the British government. Thales in Glasgow can trace its roots back to the early 20th Century, and it now supplies optronics for vessels and vehicles.

Meanwhile, Thales’ facility in Belfast has an equally rich history: previously Short Brothers, it is the epicentre for the UK’s air defence and anti-armour missile capabilities. The Lightweight Multirole Missile (LMM) and Saab NLAW – both of which have seen extensive use in Ukraine – are produced there.

The British Army’s new Boxer has several technologies installed from Thales (Photo: Defence Media)

QinetiQ was the result of a 2001 part-privatisation of the MoD’s Defence Evaluation and Research Agency (DERA), which split in two to form QinetiQ and what is now known as the Defence Science & Technology Laboratory (Dstl).

QinetiQ has significant capabilities across the defence space, including next-generation capabilities such as robotics, data fusion, cyber and AI.

Babcock is a significant player in the UK defence industry, with a key role in many of the MoD’s key programmes. The company is particularly focused on complex support services across domains. A notable example is Babcock’s ownership of the Defence Support Group (DSG), which was formerly a government entity and is responsible for the storage, maintenance, repair and overhaul of the UK’s military vehicles and equipment.

Babcock is also the lead contractor on the Royal Navy’s Type 31 programme, which is based on the company’s Arrowhead 140 design and of which five are being built in Rosyth, Scotland. The Type 31 programme has created or sustained 2,500 skilled jobs in Scotland, according to the UK government.

Defence Media will continue to update this list.

Signatories of:

Members of:

Innovation House

Molly Millars Close

Wokingham

RG41 2RX